Disclaimer: as of the time of writing I am the head of product and growth Membrane Finance, the issuer of EUROe. I don’t let this impact the numbers but I do voice my concerns which may be impacted by some implicit bias. Furthermore, the market developments section will definitely have an overweighting of EUROe related news due to my heavy exposure to all EUROe news. Furthermore, and most importantly, this text states things as of the end of December, not as some actors are portraying them to be based on predictions for 2024.

Table of Contents

Open Table of Contents

Introduction

220 million euros.1 That’s the figure where we started 2023.

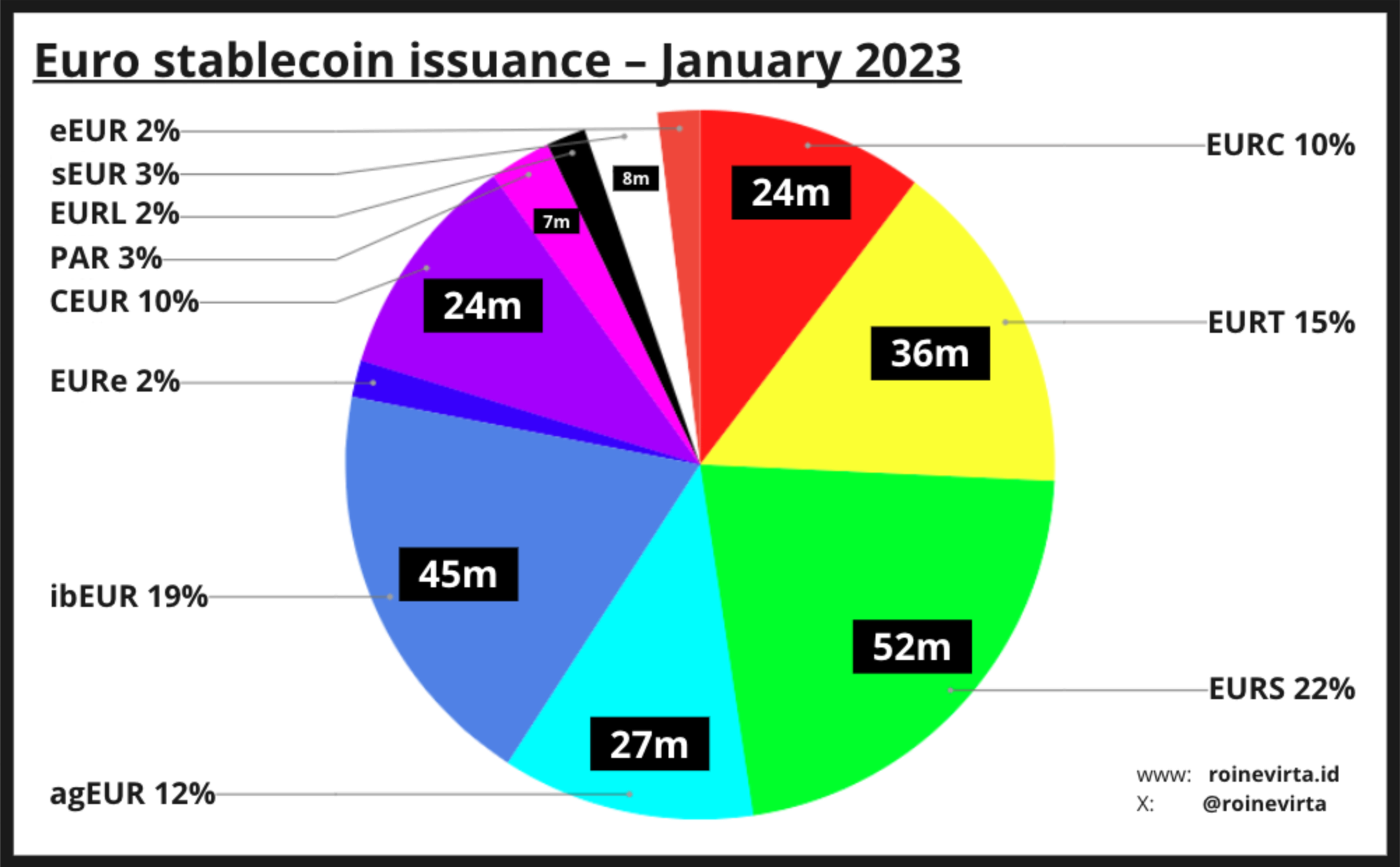

In January 2023, euro stablecoins were completely marginal; there wasn’t really anything you could do with them and there was really no liquidity for secondary market trading either. If you traded in size, you’d be better off trading with dollars and eating the FX risk. The year was to a grim start. Some teams, such as Monerium, had been grinding since 20152 with little progress to show. The top three was dominated by very questionable stablecoins.

Stasis’ EURS, a Russian run Maltese stablecoin with a weird Isle of Man corporate structure, was the largest euro stablecoin at 51 million issued.1, 3 The second place was held by ibEUR,1 issued by Iron Bank, a lending protocol that was originally spun out of the twice-hacked CREAM and which, in 2021, lost over 30 million due to bad debt from a hack on Alpha Homora.4 The third place went to Tether’s EURt, launched in 20205, at 36 million issued.1

While various forms of American onchain greenbacks commanded over 120 billion euros issued6 the euro market was pretty much non-existent at around 0.2% market share!

The age-old thinking here is that the issuance of onchain euros vs greenbacks should be somewhat representative of their usage in traditional finance. Using various metrics we can get to a figure ranging anywhere from 10% or so to approximately 50% in the euro/dollar split. In other words, as a subscriber of the efficient market hypothesis (EMH), onchain euro issuance should grow about 50-250x in 2023. Right?

Well, let’s take a look at some of the biggest developments in euro stablecoins in 2023 to see how that (did not) happen.

Euro stablecoin market developments in 2023

If you’d like to stay up to date with the euro stablecoin market on a monthly basis, I publish a monthly “State of Euro Stables” review on both LinkedIn and Twitter.

Before we get to the trends, analysis, and my takes on different euro stablecoins, let’s do a speedrun on the most important news of 2023:

The year didn’t start off very well with one of the first meaningful news pieces coming from “e-Money”, a Danish fintech which issued the eEUR stablecoin on Cosmos.7 They announced the end of operations for eEUR with redemptions live only until March 6th, giving holders a mere two months to get their funds back. Today, almost half a million eEUR survive as a slightly off-peg asset and extremely illiquid asset on Cosmos.8

This news served as a great reminder to everyone the importance of stablecoin redeemability and consumer protections. Accordingly, MONEI announced that they joined the Spanish Financial Sandbox – giving them the ability to issue up to 10 EURM euro stablecoins per person.9 However, if 10 onchain euros wasn’t enough for you, Membrane Finance, which received its EMI licence the previous year, launched the first EU-based onchain electronic money, EUROe, in February.10

To continue the narrative of “compliant” stablecoin launches, SG FORGE, Societe Generale’s crypto-focused subsidiary, launched its EURCV stablecoin in April.11 However, SG decided to follow their own proprietary CAST-framework, instead of opting for electronic money or payments services regulation. Further casting doubt on EURCV’s relevance and usability, SG limited circulation to whitelisted parties only requiring each transaction to be separately approved by SG – similar to bank transfers.12, 13 Furthermore, the actual implementation was riddled with flaws and gas inefficiencies – not a good look for a bank subsidiary trying to enter the market!14, 15

In May, both EURC (formerly EUROC) from Circle and EUROe from Membrane Finance also launched on Avalanche. Angle, issuer of the agEUR stablecoin, also published a whitepaper describing the new “Transmuter” -mechanism which would modify the issuance and redemption mechanisms of agEUR considerably in the aftermath of the USDC depeg earlier in the year.16

In June, the EU’s Markets in Crypto-Assets Regulation (MiCAR) was ratified. This was one of the biggest news of the year as its application on stablecoins would begin in June 2024.17 The implications of MiCAR are still being hashed out by both industry actors and the regulatory bodies. Click here to read my primer on MiCAR. Bluechip, a non-profit stablecoin rating agency, assigned EURt the “D” rating, citing poor backing, among other factors.18

Towards the year end the news cycle really cooled down. EUROe launched on Solana, marking the debut of the first euro stablecoin on the chain in August.19 The following month Angle launched stEUR, an interest bearing version of their agEUR stablecoin.20 In December, we saw two major listings with Binance – which had earlier said it will delist all stablecoin in the EU next year – launching the new AEUR stablecoin from Anchored Coins and Bitstamp listing EURCV.21, 22, 23, 24 The former’s price jumped by around 200% at listing, reminding that market makers are important for the secondary markets of stablecoins as well.

Trends

Issuance

The year ended with approximately 260 million issued,1 adjusted for double counting. Overall, the euro market grew almost 20% year over year as measured in euros issued – contrary to what the EMH would suggest.

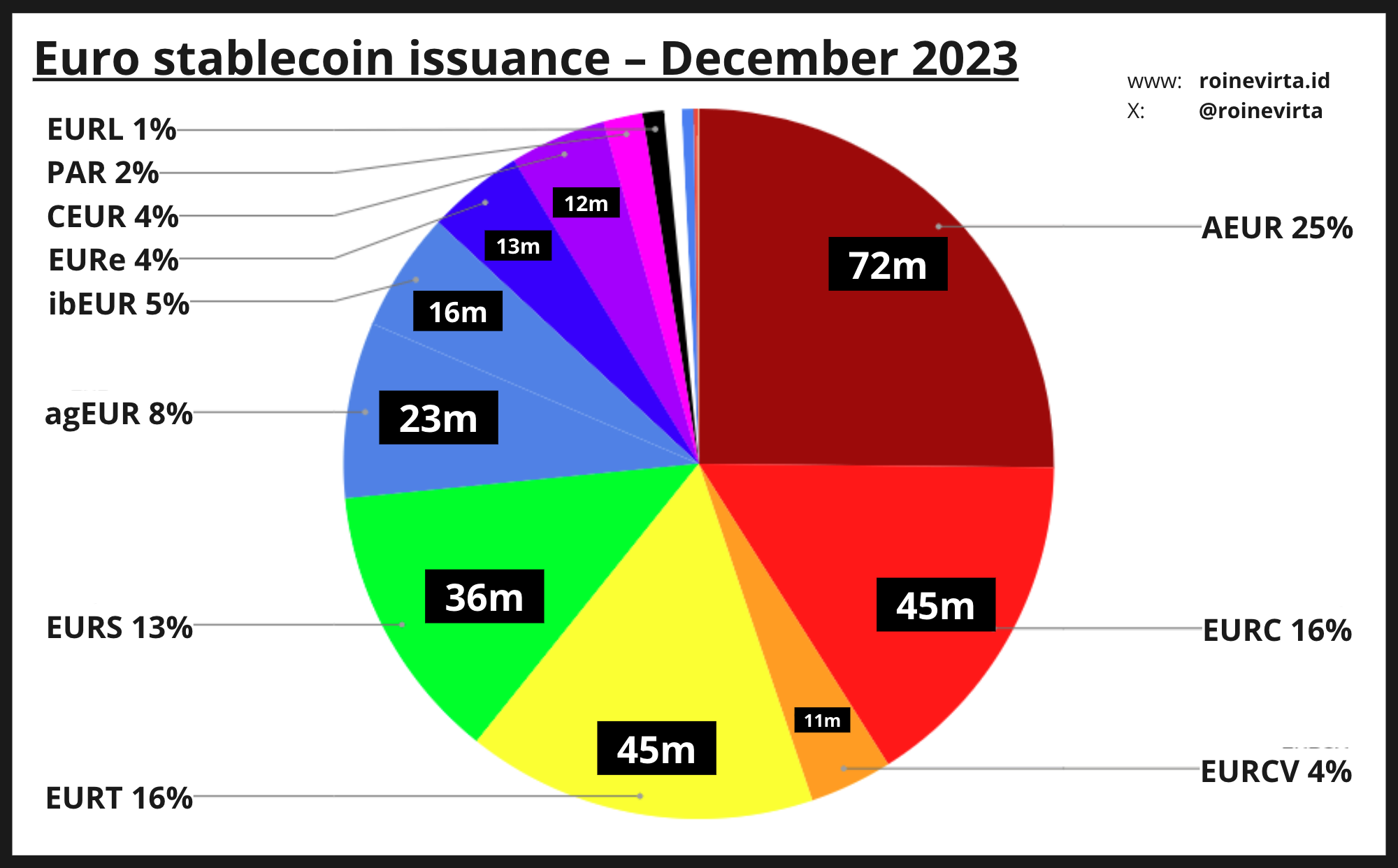

Composition

The market composition has changed considerably with every stablecoin moving up and down the issuance ranks. The biggest movers were eEUR from e-Money which moved seven places down from 9 to 16 and EURe from Monerium which moved four places up from 11 to 7. When including stablecoins that weren’t issued at the beginning of the year, AEUR from Anchored Coins took the market by surprise growing to over 70m in issuance in under a month – taking the number 1 spot. This was largely driven by Binance’s decision to list AEUR as their go-to euro stablecoin.

The top 5 largest stablecoins (rank change) at year end are:

- AEUR at 72m€ (+12)

- EURT at 45m€ (+1)

- EURC at 45m€ (+3)

- EURS at 36m€ (-3)

- agEUR at 23m€ (-1)

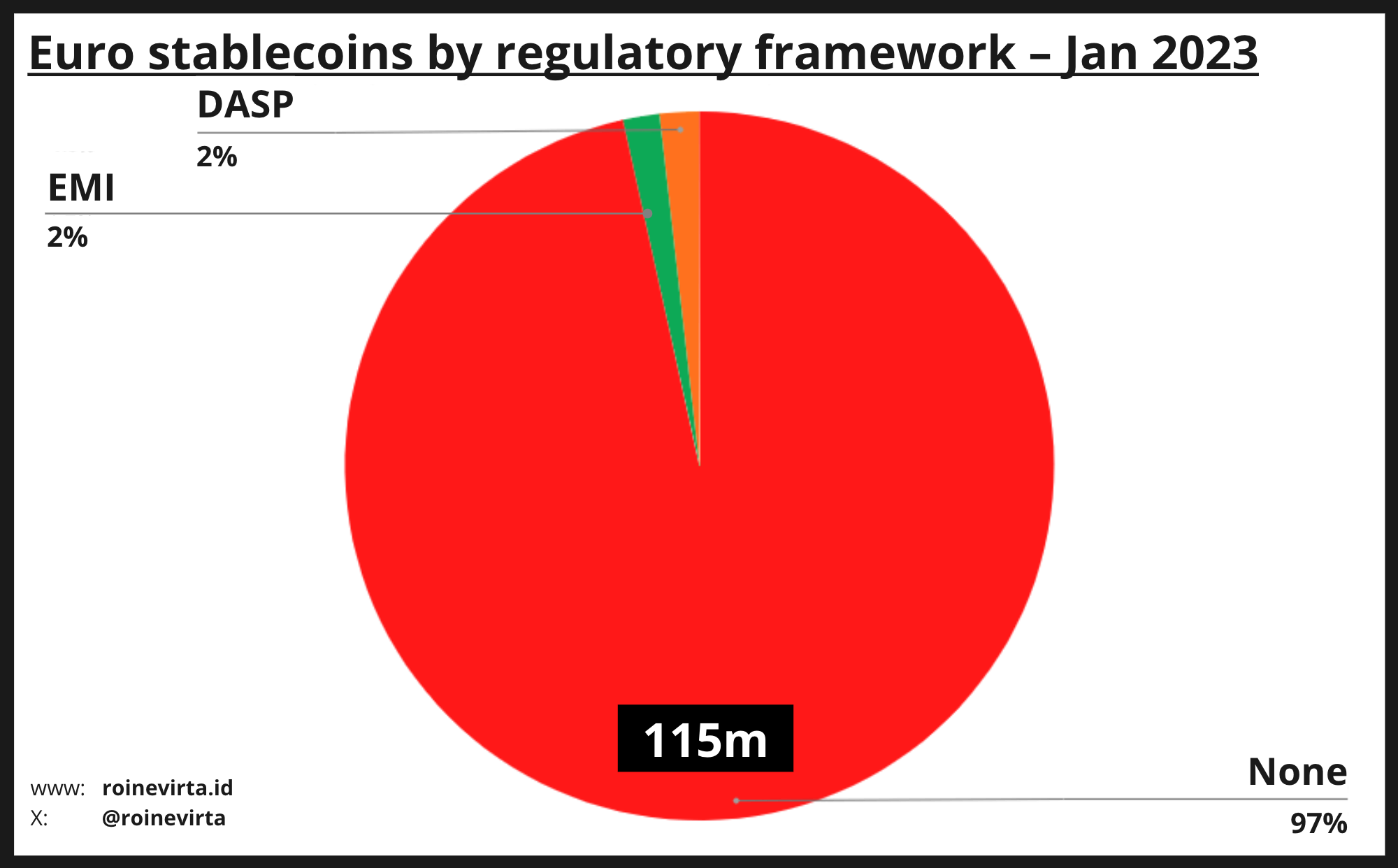

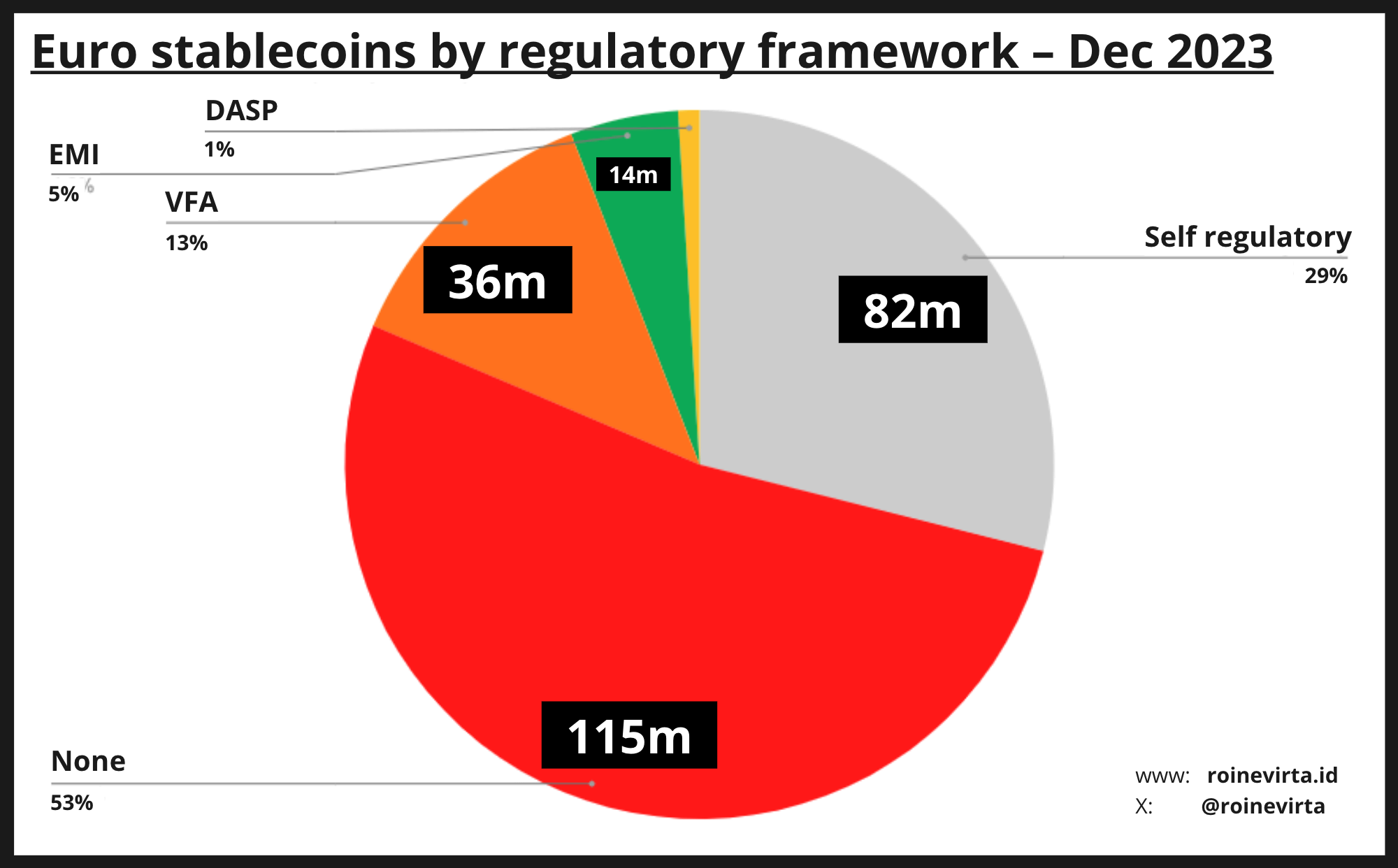

As we can see from the above pie charts, the market composition has shifted greatly, largely driven by new market entrants, such as EURCV and AEUR, and the exit of other issuers such as eEUR.

Generally, it seems that the market share of the “shadiest” stablecoins is decreasing which is great news for the ecosystem in general. This is with the exception of AEUR, of course, which has a very interesting background.

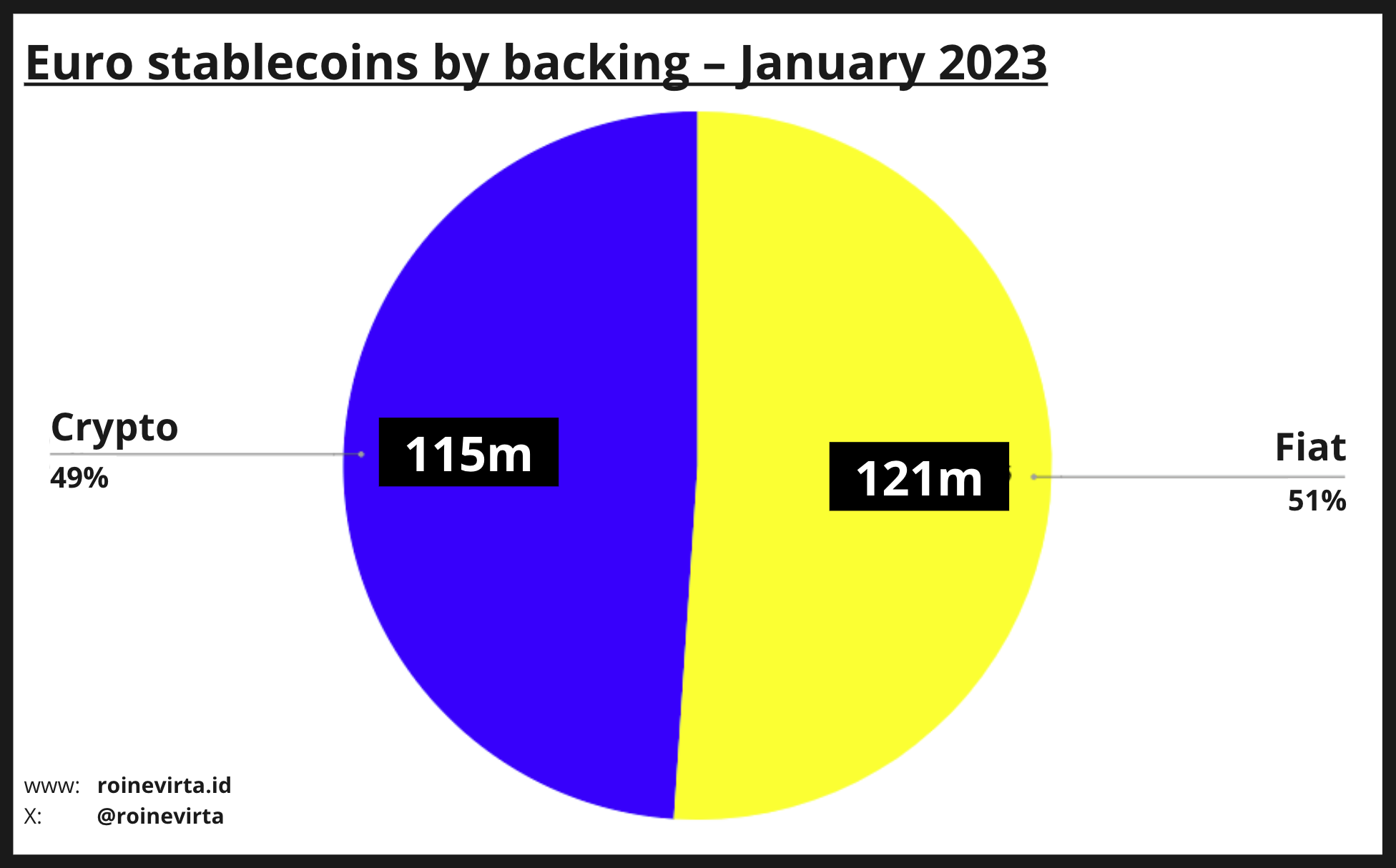

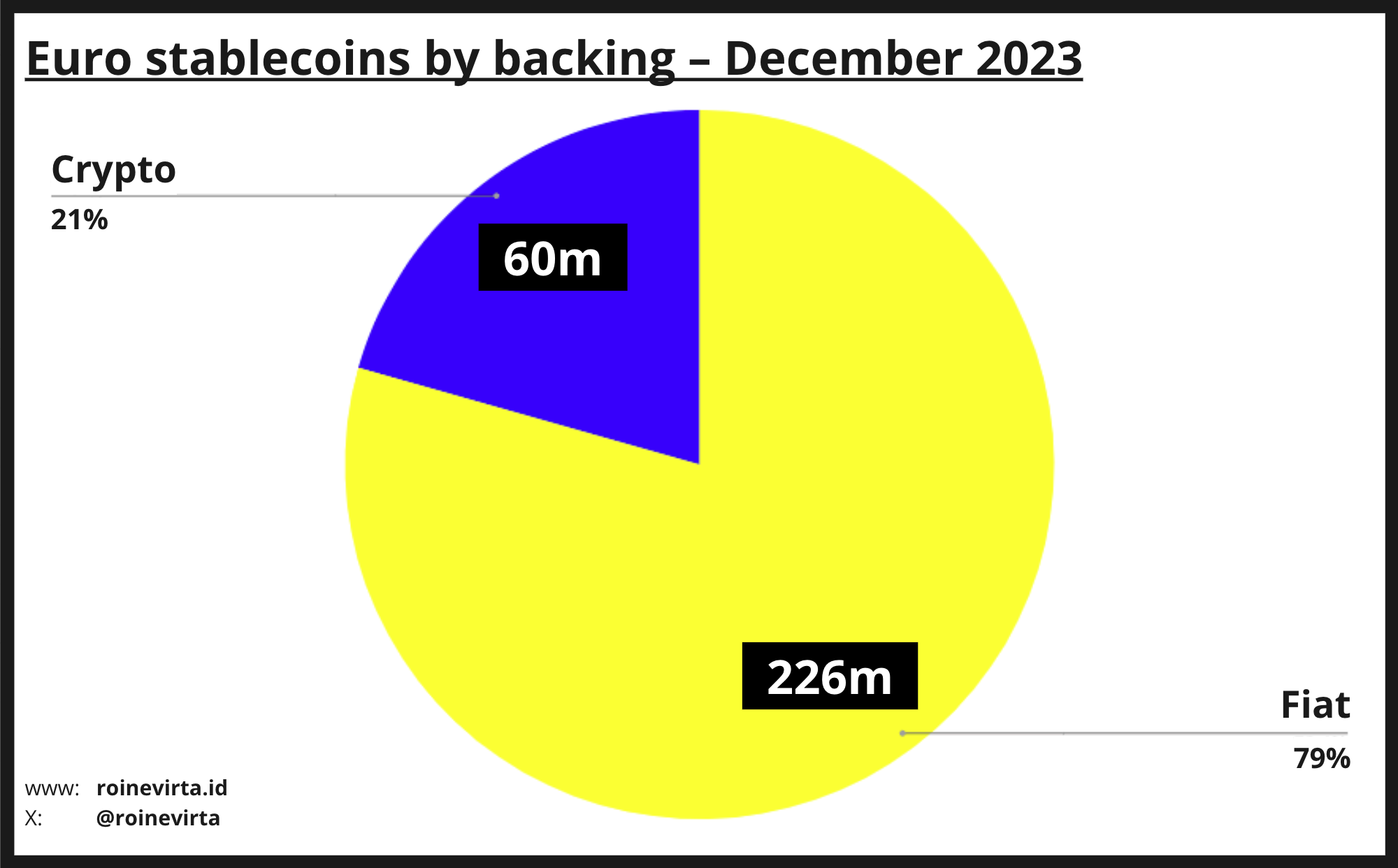

The backing of euro stablecoins is also beginning to more closely resemble the backing of USD stablecoins; fiat dominates. Roughly 93% of the USD stablecoin market is fiat backed stablecoins. The euro market has gone from 51% in the beginning of the year to 79% at the end of the year. There’s still some catching up to do, assuming the euro market would resemble the relative market shares of their greenback counterparts. I doubt this might not be the case, however, as 2024 will be riddled with various projects trying to skirt MiCAR through being “decentralised”.

The European Commission would be happy to find that the manner in which euro stablecoins are overseen also significantly improved. From a state of almost total non-compliance in the beginning of 2023, we have moved to a state where almost 5% of the stablecoins issued have a feasible pathway towards MiCAR compliance.

The developments have not been as straightforward as some might have liked; the rise of “self regulatory organisations” was mainly driven by AEUR’s Swiss incorporation. Furthermore, Stasis’ VFA registration is not compatible with the upcoming regulations and EURCV’s CAST framework does not fit any regulatory framework as of today. While the red has been getting smaller, there’s plenty of work to do if the iron fist of the EU really hopes to crush non-compliant stablecoins.

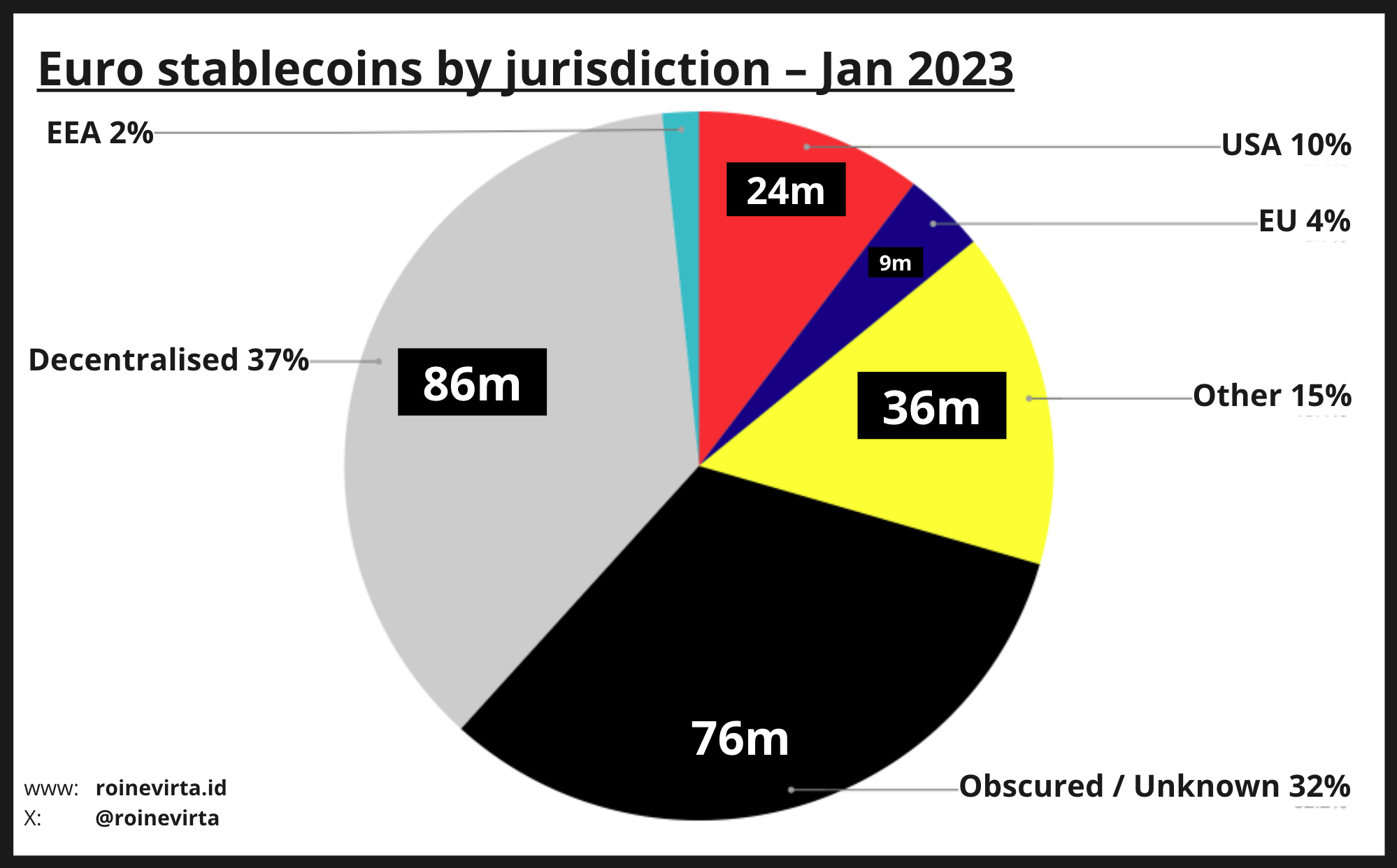

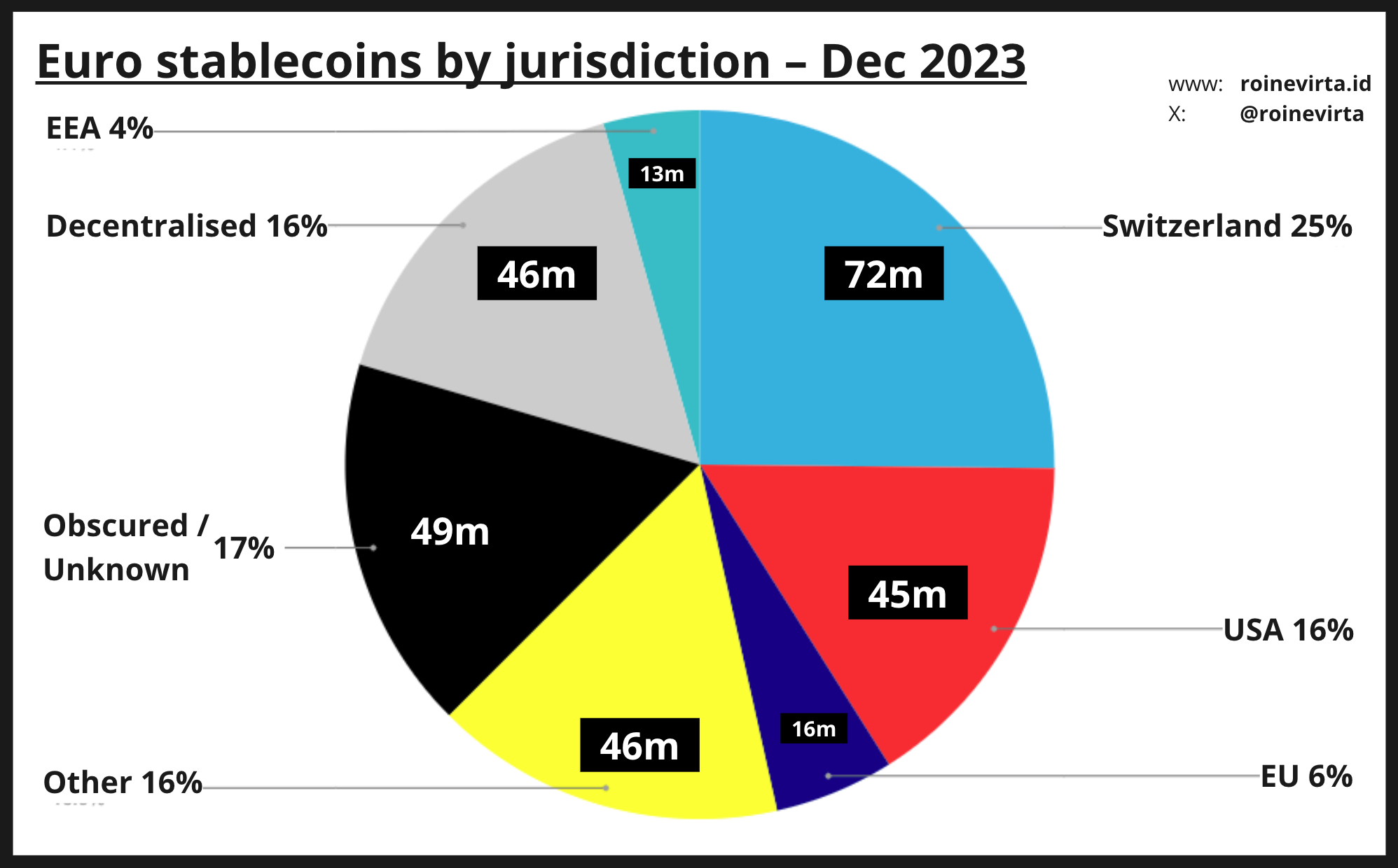

Choice of jurisdiction, as measured by stablecoins issued, has also been subject to a lot of turmoil. Specifically, known jurisdiction dominance has increased, while the share of “decentralised” or obscured jurisdiction has decreased. EU-based stablecoins have also seen almost a 50% (1.8pp) increase in their dominance. Small, yes, but not nothing.

Market map

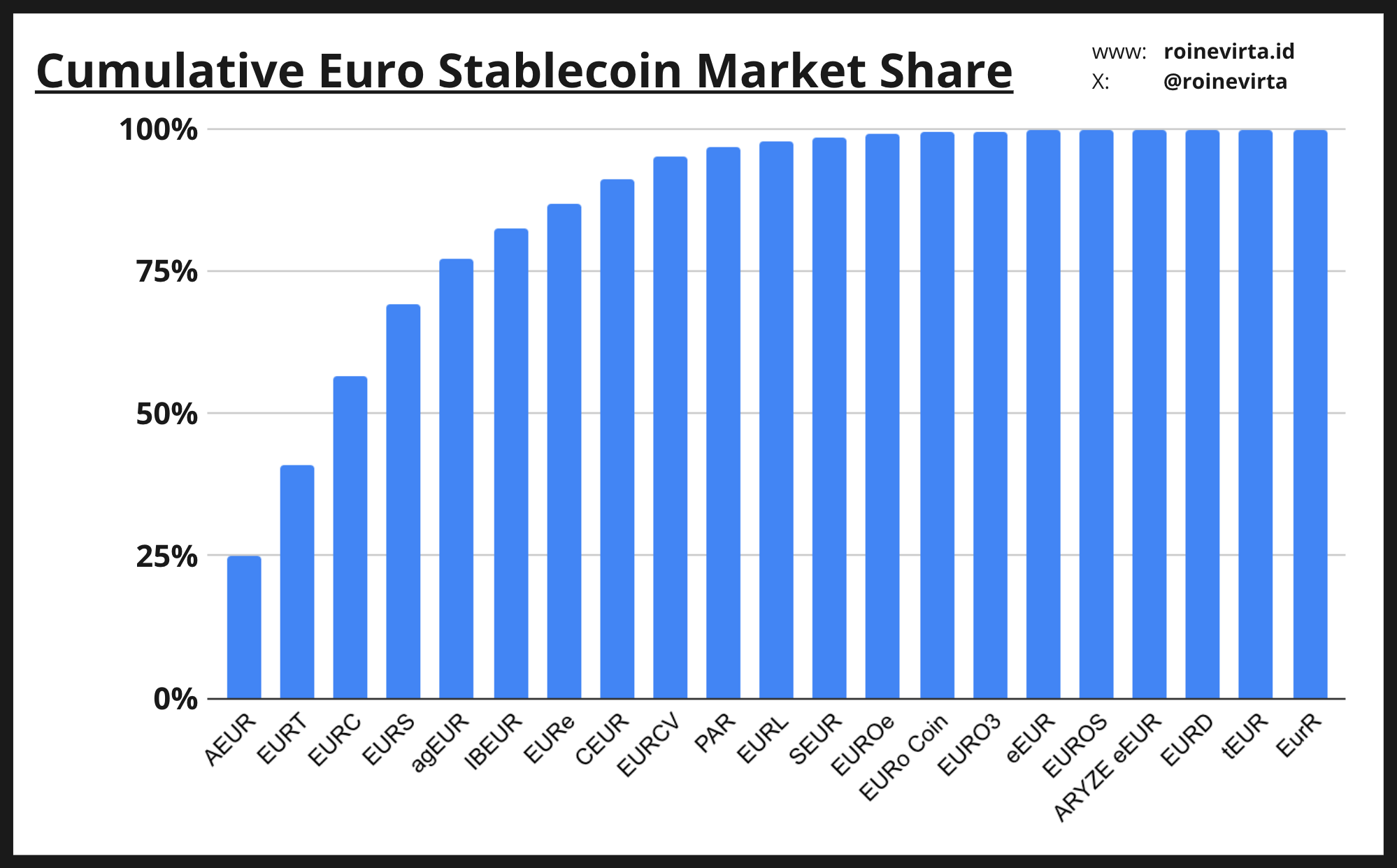

The euro stablecoin market has seen a proliferation in the number of active projects, which by my count stands today at 20. As usual, the power law applies here. The top 5 projects issue 75% of circulating stablecoins, the top 12 issue 99%.

Figure 9: Cumulative euro stablecoin market share

Figure 9: Cumulative euro stablecoin market share

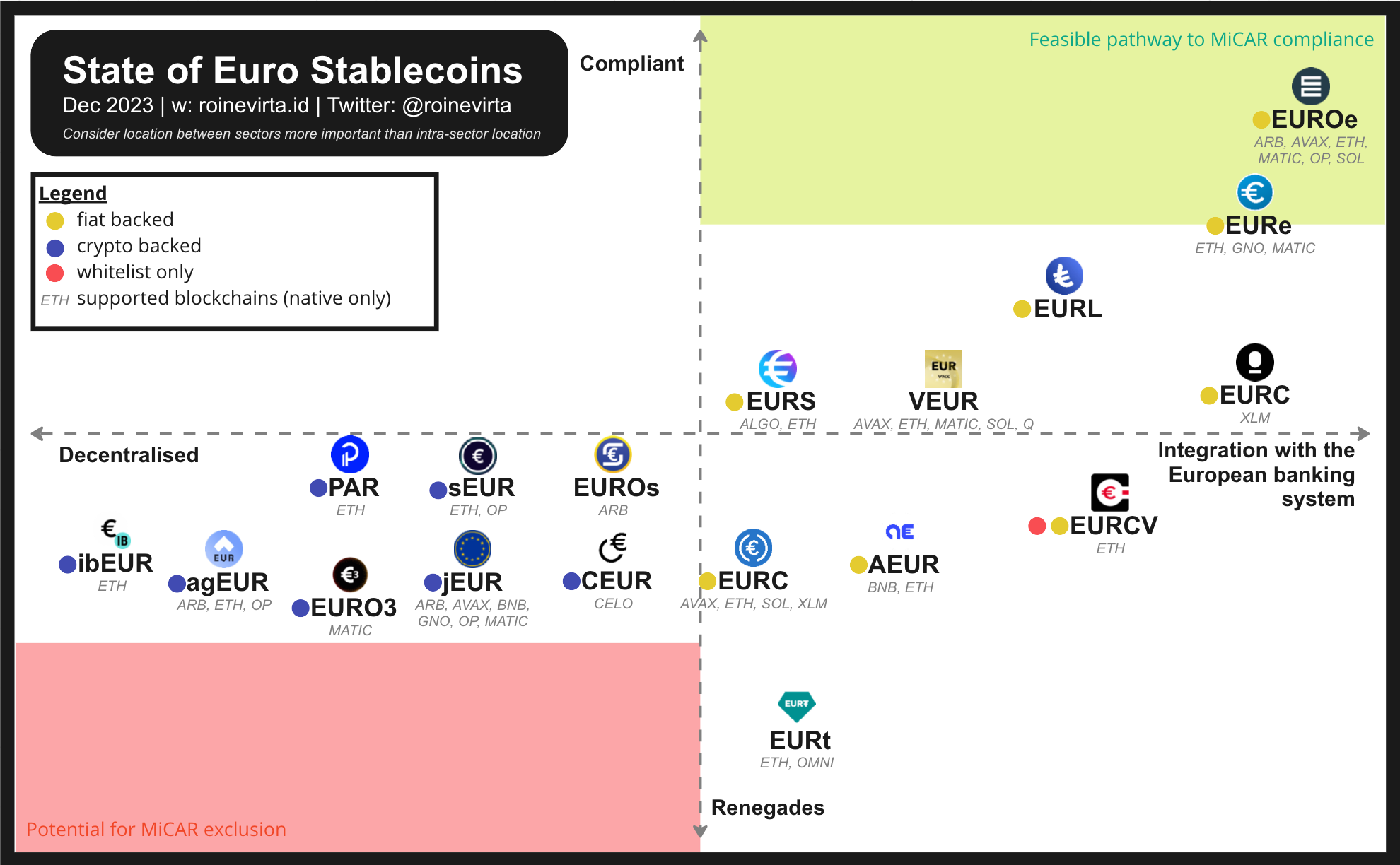

These market shares, however, are not directly reflected on how the same stablecoins fair on aspects of decentralisation, compliance, or other clear metrics. In fact, based on experience, non-compliant stablecoins have an edge over compliant stablecoins because the latter cannot participate on the secondary markets.

Figure 10: Map of euro stablecoins

Figure 10: Map of euro stablecoins

The below stablecoin further elaborates on the properties of the most relevant of the stablecoins.

| Ticker | Issuer | Jurisdiction | Regulatory framework | Backing | Bankruptcy guarantees | Blockchains |

|---|---|---|---|---|---|---|

| AEUR | Anchored Coins AG | Switzerland | VQF self regulatory organisation | 100% cash | Some25 | BNB, Ethereum |

| EURT | Tether Operations Limited | Hong Kong | None | Basket of assets28 | None26 | Ethereum, Omni |

| EURC | Circle Internet Financial LLC | USA | None | 100% cash | Some27 | Avalanche, Ethereum, Solana, Stellar |

| EURS | STSS Limited / STSS (MALTA) LIMITED | Isle of Man / Malta | Virtual Financial Assets Framework | Partial cash backing36 | None | Algorand, Ethereum |

| agEUR | Angle Labs Inc. | Undisclosed | None | CDP (wstETH, wBTC, USDC…) + Transmuter (EURC, bC3M) | N/A | Arbitrum, Ethereum, Optimism, Polygon |

| EURe | Monerium EMI ehf | Iceland | Electronic Money Institution | Cash + credit instruments29, 30 | Issuer bankruptcy remote | Algorand, Ethereum, Gnosis, Polygon |

| EURCV | SG FORGE | France | None | 100% cash | Issuer bankruptcy remote31 | Ethereum |

| EUROe | Membrane Finance Oy | Finland | Electronic Money Institution | 102% cash | Issuer bankruptcy remote, bank bankruptcy remote | Arbitrum One, Avalanche, Ethereum, Optimism, Polygon, Solana |

| EURo Coin | MYKOBO UAB | Lithuania | Virtual Currency Wallet Operator, Virtual Currency Exchange Operator | min. 100% cash37 | None | Stellar |

| EURO3 | 3A DAO LLC | Undisclosed | None | CDP | N/A | Polygon |

Table 1: Partial list of euro stablecoins as of December 2023

For a full list of euro stablecoins, please visit the Euro Stablecoin Research repository here.

Key market participant analysis

Below I extrapolate a bit more on six euro stablecoins – AEUR, agEUR, EURC, EURCV, EURe, and EUROe.

Anchored Coins’ AEUR – the Binance prodigy

Anchored Coins is the Swiss issuer of AEUR and ACHF – euro and Swiss Franc stablecoins, respectively. The AEUR contract was first deployed on the BNB Chain in July 2023 but it remained mostly dormant until November. There is very little public information available about the company, but sources indicate it was founded by Calvin Cheng, a former Singaporean nominated member of parliament.32

AEUR rose to the public’s attention in December when Binance listed AEUR on their platform. AEUR’s supply grew from less than a million to over 70 million euros before year end. It’s initial price action on Binance was very volatile, with users bidding its price above 2.50 euros.33

It seems that AEUR came quickly from nowhere and took the euro stablecoin market by surprise as Binance continues to look for a way to continue operating in Europe after June 2024 when the USD-stablecoin ban in Europe comes to force (which I wrote about here). There’s very little indication of AEUR’s go-to-market strategy or features so analysing its position going into 2024 is very hard.

However, I see that AEUR will be subject to heavy MiCAR related compliance risks as a Swiss-based stablecoin. Either it will need to transform its corporate structure or continue operating on the dark grey fringes of the market.

Angle’s agEUR – the largest crypto-backed euro stablecoin

Angle, a French-led decentralised finance protocol with modules deployed on Polygon, Arbitrum, Optimism, and Ethereum, is the largest crypto-backed euro stablecoin today. Earlier in 2023 the Angle team introduced the transmuter, an autonomous price stability module for issuing stablecoins, to complement its existing collateralised debt position (CDP) system design.

Motivated by the Euler hack and the USDC depeg,34 the transmuter aims to reduce losses and volatility to agEUR users by backing it with a basket of euro-denominated assets, currently Backed Finance’s bC3M and Circle’s EURC.

agEUR’s market capitalisation has been trending down from 32m to 28m (-13%) despite continuous innovation and wide crosschain availability through third-party bridges and LayerZero’s OFT standard adherence. Angle’s focus has been on transparency and DeFi integrations but, as many other euro projects, they have suffered lack of interest from dApp developers.

Figure 11: agEUR supply

Figure 11: agEUR supply

2024 will be extremely challenging for Angle as MiCAR comes into effect in June and Angle having no pathway to compliance (as euro stablecoins, or electronic money stablecoins (EMT), need to be fiat backed). The only feasible pathway for Angle, as for many other decentralised stablecoins, would be exclusion from MiCAR but that seems outright impossible, especially with a doxxed European team behind the project.

Continuing with Angle may come at a great personal risk or cost to its founders and employees, but if they decide on continuing, it has great potential in becoming the DeFi euro stablecoin. It is already one of the most widely integrated euro stablecoins on the market plus its transmuter design contributes positively to incentive alignment with fiat-backed stablecoin issuers who are included in the module.

agEUR’s closest competitors – or more accurately co-opetitors 35 – are the other French euro-stablecoin project Jarvis with its jFIATs and the two new DeFi stablecoins on the block: 3A DAO’s EURO3 and The Standard’s EUROs (which is not off to a great start).

Circle’s EURC – Americans exporting euros

Circle’s EURC has been on the market since mid-2022 but there’s been very little activity around it (in relation to USDC). In fact, it was mentioned just a few times during the Circle executive leadership discussion. This is understandable, as EURC is still operating as an unlicenced product in the EU.

Nevertheless, EURC grew rapidly from 24m to 45m (+88%) during 2023. Still, it has not accomplished the same DeFi market penetration or integrations as other fiat-backed stablecoins such as EURS – with its first-mover advantage – or EUROe with its multichain distribution.

Figure 12: EURC supply

Figure 12: EURC supply

As with USDC, Circle’s focus on EURC is seemingly on the enterprise/corporate side. However, they are actively engaging DeFi protocols as well in an effort to increase EURC market penetration.

Circle’s key challenges in 2023 were around their inability to acquire a European licence, putting their operations after June 2024 at risk. Furthermore, Circle has not shown any understanding of the European market. This has been highlighted, among other things, by the lack of a European bank account for minting and redemption of EURC.

I would imagine EURC is important to Circle strategically, should they want to continue operating in the EU after 2024. Therefore, I would assume Circle has to make a decision – whether to double down on USDC and drop EURC completely, or whether to give the European operations more autonomy. Continuing EURC operations is likely contingent on their licence, but Circle has been prepping for the latter scenario by making noise about their hiring and “progress” in the EU.

Circle’s biggest risks for 2024 come from the potential of no licence which would mean a complete stop to their EU operations. Other risks come from the lack of understanding of the European crypto market – Circle’s EURC business development is still headed from the US – and the general inability of the European branch to steer a larger organisation to their needs if there is no management buy-in.

At a larger scale, there is general resistance within the supranational bodies to – yet again – give control of the emerging financial system to an American company as this might lead to continued overreliance on foreign financial markets infrastructure (FMI). The same sentiment has been echoed by multiple parties that would be the direct customers of Circle – European companies.

Should Circle be able to overcome the challenges, they are well positioned to become (one of) the largest euro stablecoins in the market. They have existing brand equity within crypto native, a good partner network, and large resources.

Circle’s largest challenger is EUROe with a similar customer segment focus.

SG FORGE’s EURCV – bankers misunderstanding crypto

EURCV from SG FORGE, a subsidiary of the French Société Générale financial group, is the closest attempt that we have seen to TradFi trying to create a stablecoin. Launched in April 2023, the stablecoin remained extremely dormant until a listing announcement on Bitstamp in December. The total issuance of EURCV stands at ~11m today with mere six holders due to its whitelist requirement.

EURCV has been plagued from the beginning. It first launched with flawed smart contracts and zero integrations, with the issuer printing 10m EURCV with no use cases. Furthermore, the issuer had to separately approve each transaction (we cannot outcompete the banks, right?). The only visible accomplishment from SG FORGE has been the listing on Bitstamp, where, unfortunately, EURCV is useless as it cannot be transferred outside of the exchange due to the need for SG FORGE to whitelist all EURCV holders.

EURCV remains an interesting beast; with zero functionality to the average crypto user and extremely bad regulatory standing (they decided to develop their own framework (“CAST”) and use it instead of a recognised framework like electronic money) and limited user-protections, EURCV seems like a big miscalculation from SG FORGE.

Still, I would not be so quick to discount EURCV. It may have some use cases either within the financial group or within certain emerging ecosystems.

However, with the immediate market for euro stablecoins being crypto-natives, EURCV seems to have completely missed the forest for the trees. The biggest growth opportunities for SG FORGE in 2024, therefore, seem to be in whitelabel and proprietary use cases, rather than within the existing crypto market. If they wanted to participate in the existing crypto market, they would need to make some large changes, both infrastructurally and in their culture.

The biggest competitors for EURCV are likely other bank-coins that have not been so vividly talked about in the crypto community – think euro versions of JPM Coin and the like.

Monerium’s EURe – the consumer on/off-ramp

The Monerium team has been working on a Euro stablecoin since the ECB deposit facility rate was -0.30%. While the team has historically been unable to show progress, this year was pretty good for them! EURe’s market cap grew from 1.5m to 13m (~9x!), largely driven by the improvements and marketing of their key product, which is an IBAN-linked wallet.29 In a nutshell, Monerium’s banking partner issues you an IBAN to which you can send funds to and receive them as EURe on-chain. Vice versa for withdrawals.

Figure 13: EURe supply – starting from March 2023

Figure 13: EURe supply – starting from March 2023

Monerium did not launch anything “new” or “big” in 2023, but kept grinding through the bear. That footwork has led to increasing supply, driven mostly by activity on the Gnosis blockchain.

Monerium’s focus has been on their retail on/off-ramp solution which offers a zero-fee method for moving between fiat off- and on-chain. However, the team has recently paused new registrations for its app allegedly due to risks related to EURe’s end-users’ gambling activity. Monerium also struggled with EURe adoption and integrations on the DeFi side along with other euro stablecoins. Building secondary market liquidity has been especially hard for Monerium as it cannot participate on the secondary markets as a financial institution.

The challenges for Monerium in 2024 are multifold.

On the end-user side, they will need to ensure scalability of their systems. Given the way Monerium (and all other fiat stablecoin issuers) makes money, which is on the net interest margin on the deposits, they cannot realise too much upfront costs as this eats into their investment returns. With Monerium the challenge is in that the costs of completing know-your-customer due diligence, the ongoing costs for AML and KYT, and the banking costs related with retail activity are extremely high in relation to the returns per customer. To address this Monerium will need to severely improve their internal infrastructure and banking networks to enable scaling or pivot away from serving retail users.

As an added strain on Monerium are the uncertainties about the applicability of MiCAR to non-EU issuers. The Icelandic parliament would need to independently ratify the same regulations before they can be applied to Monerium. While I do not pretend to be a lawyer, to my understanding there may be some risks during this transitory period. Furthermore, the oversight of significant stablecoins, which Monerium likely strives to become, is transferred from the national competent authority (NCA) to the European Banking Authority (EBA). It is unclear to me how, if at all, this is possible when the original NCA is not part of the EU.

Thirdly, Monerium suffers from their inability to participate on the secondary markets. As a financial institution (an electronic money institution), they cannot provide liquidity or buy and sell EURe within DeFi. This places a huge constraint on the potential of integrations for EURe in 2024.

Fourth, and not least, it looks like Monerium’s focus is fragmenting. They recently added the tickers “GBPe” and “USDe” to their Twitter profile, indicating they may be on the mission to bring these ideas from 2022 (USDe was deployed in November 2022) back online. Hopefully these initiatives do not interfere with Monerium’s focus on EURe nor on their ability to remain compliant within the EU.

The fifth, and perhaps the largest problem, is related to EURe’s distribution. As Monerium serves the end user directly, they are also a direct competitor to the existing market infrastructure – and hence the current distribution channels. Centralised exchanges would rather not list EURe as it could eventually compete and cannibalise their own business. This presents a huge distribution hurdle for Monerium.

If, however, Monerium is able to overcome these multitude of problems they have a clear pathway to becoming (one of) the most used euro stablecoins. The user experience is top notch and if the team keeps delivering, a large fraction of the crypto<>TradFi transactions are poised to go through Monerium. This, however, might not translate to growing supply if users instantly swap to and from EURe, using it more as a gateway rather than as the safe-haven asset.

The largest competitors for Monerium aren’t other euro stablecoins. The competition is the current on/off-ramp infrastructure such as Coinbase, Kraken, Transak, MoonPay, etc.

Best of luck to the Monerium team in 2024.

Membrane Finance’s EUROe – the enterprise stable

Disclaimer: I am the head of product and growth at Membrane Finance

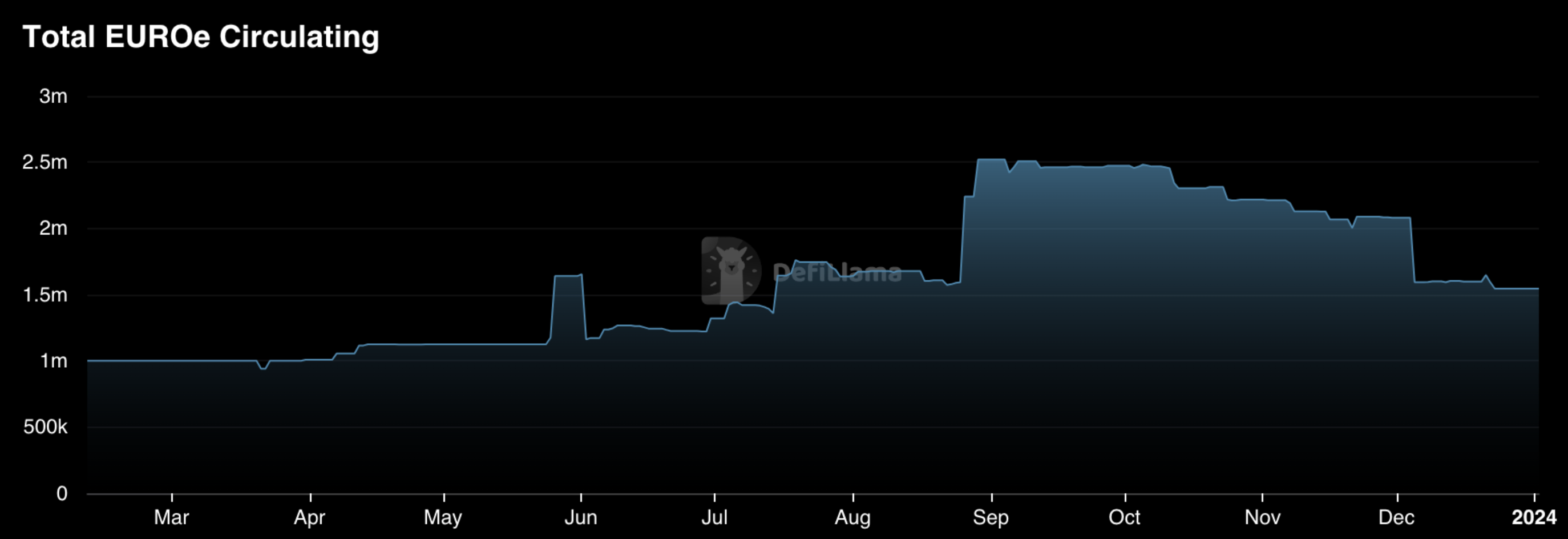

Membrane’s EUROe was launched on Ethereum in February 2023 following the completion of their licencing process in November 2022. EUROe, like EURe, is regulated as electronic money with its supply standing at around 1.5m as of year end. Membrane provides companies a free 1:1 on- and off-ramp between six blockchains and the traditional financial system through GUIs and APIs.

Figure 14: EUROe supply – starting from February 2023

Figure 14: EUROe supply – starting from February 2023

While Membrane launched on six blockchains, saw usage within regulatory sandboxes, and integrations in non-crypto-native applications, its integrations and usage within DeFi has been limited.

Membrane’s focus is on their enterprise and corporate offering which provides companies next generation compliant tools for interacting with the blockchain. Not unlike Monerium, Membrane has also suffered from its inability to participate on the secondary markets of EUROe, making scaling and distributing it extremely challenging.

Membrane’s challenges for 2024 include the distribution and market penetration of EUROe.

Should Membrane be able to clear these hurdles, it has a clear track to becoming (one of) the largest euro stablecoins due to its robust regulatory standing, infrastructure, scalability, and multichain availability.

Challenges

In general, the euro stablecoin market has been challenged by general lack of growth. Excluding AEUR, the market shrunk 21m euros, or about 9%. Including AEUR, the market grew 51m (22%). Regardless of which figure we look at, you cannot see the stablecoin pie chart slice of euros.

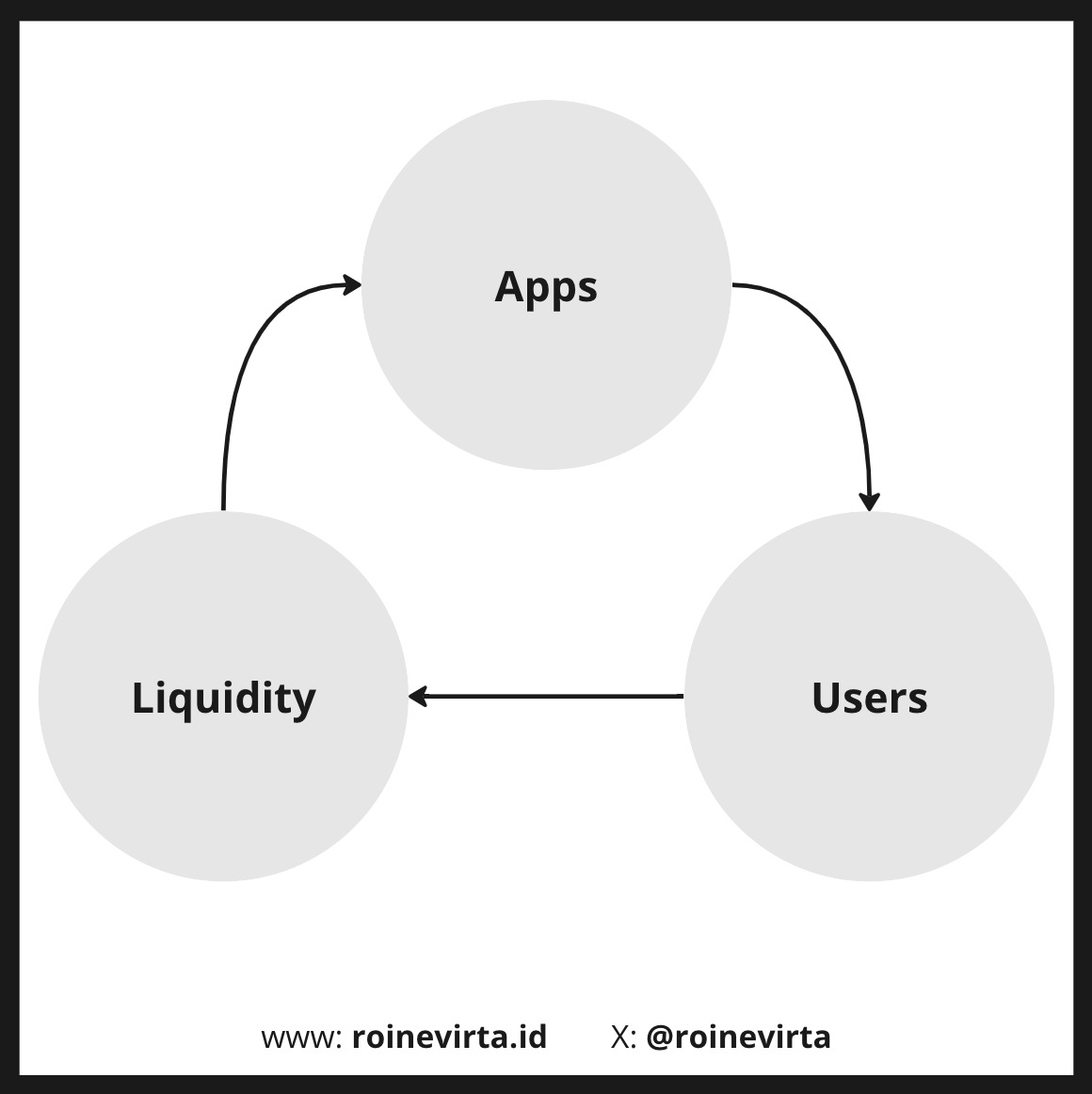

This lack of aggregate growth has been driven by a few factors: the chicken and egg problem, lack of understanding, gatekeeping, and lack of availability & accessibility.

The chicken and egg problem with euro stablecoin adoption stems from the following cycle:

Figure 15: The euro stablecoin chicken and egg problem

Figure 15: The euro stablecoin chicken and egg problem

Users will not come unless there are apps. Apps will not come unless there is liquidity. Liquidity won’t come unless there are users.

These problems are further exacerbated by the risk aversion of app developers to building applications for Europeans. In the status quo everything in DeFi is denominated in dollars. The ecosystem would require a large euro capital injection along with cooperation from a few key core dApps to bootstrap euro usage.

I believe that the first one to do so successfully will capture large market share as a first mover as Europeans prefer transacting in their own currency and not dollars.

Users, i.e. Europeans have not been vocal enough about their preference to use euros. This stems from a lack of understanding; the average user does not realise (or care – which I hope is not the case) how much risk they are taking by transacting dollars.

As a concrete example, say that you converted your 1000 euros to USDT on the first of January 2023 and got 1066 USDT. You then put these assets to yield farming and cashed out on December 28th. If you realised a 3% yield, you would be 10 euros worse off. If you got 5%, you would be 10 euros better off – but you still left 40 euros on the table assuming yield parity.

If users understood these risks better – and were more vocal about it – the euro stablecoin market could grow in aggregate.

But even when users do voice these concerns, dApps may be prevented from doing anything through gatekeeping. Most dApps require an oracle feed, either from Pyth or Chainlink, to integrate a new token. Neither provides a feed for any of the European stablecoins at time of writing, creating yet another hurdle for “decentralised” finance.

The easy fix would be to use a EUR/USD fx-feed. But this would shift risk to consumers. Henceforth, we’d need better and more decentralised solutions for pricing assets, especially real-world assets. The current oracle feeds used within today’s systems are not scalable or reliable enough to support the long tail of assets.

And because there are no dApps, no users, and no liquidity, there are plenty of hurdles in accessibility & availability for the average user. With the exception of EURe, you cannot acquire euro stablecoins at fees competitive to those of USDC or USDT. Again, USD has had a first mover advantage and the UX has been polished for crypto users, but not European crypto users.

This is partially a market structure problem as well; much of the European crypto markets volume is catered to by smaller “local” “brokers” that charge high fees for their service. There is no singular large exchange, like Coinbase, to facilitate our trading volume. In the absence of real euro-centric crypto competition, which I think will change with MiCAR, us Europeans have been left with an inferior crypto UX.

The fix would be for some exchange to truly position themself as the European exchange. I believe we will see the competition for the title of the Best European Exchange really ramp up in the next few years as MiCAR places heavier requirements on how exchanges need to treat their customers.

Brighter skies in 2024?

The Markets in Crypto-Assets Regulation, or MiCAR, was definitely the largest singular piece of euro stablecoin market development in 2023. And it will continue to define how we fair in 2024. Due to the de facto USD stablecoin ban stemming from MiCAR, we will see a large shift in the European crypto markets in 2024. If exchanges are able to deliver on their requirements and onboard euro stablecoins as USD replacements, there will be extreme euro stablecoin growth. If not, euros will continue on their path to irrelevance until there is a production use case outside of the current crypto ecosystem – which may be much closer than you think.

Based on the trends discussed in this post, I think we will see:

- More euro stablecoins emerging in 2024, both centralised fiat-backed stablecoins embracing MiCAR and decentralised projects trying to circumvent MiCAR

- Either limited euro stablecoin issuance growth where the share of euros relative to dollars stays approximately the same or fast explosive growth where euro stablecoins become much more prevalent both in DeFi and on CEXes

- Contingent on issuance growth we will see a bifurcation in jurisdictions; EU-based stablecoins will grow in number and issuance, but so will a few select offshore locations, such as Singapore, BVI, or the Caymans. The offshore euro stablecoins will try to win market share in a race against their “onshore” counterparts through various DeFi native mechanisms.

- Consolidation in stablecoin licencing will lead to most issuers relying on an EMI licence in 2024. VASP and other licences become irrelevant and won’t be tolerated by exchanges and other TradFi touchpoints. Credit institutions will not enter the game in any relevant manner until 2025 or later.

- Fiat euro stablecoins will grow larger in dominance in relation to their crypto-backed counterparts – unless Angle is able to expand their stablecoin backing to such a state where fiat-backed stablecoin issuers “outsource” their work to Angle and enjoy returns through Angle’s growth.

Taking the optimistic outlook, there are a few extreme growth opportunities for euro stablecoin adjacent markets in 2024:

- DeFi: a first mover in creating a European DeFi experience that is all denominated in euro stablecoins (and the € sign) can amass large liquidity and competitive edge. Every cycle the market entrants are slightly less sophisticated and hence want to have the comfort of their own currency when they are trading.

- Banking: the banking layer for stablecoin issuers is still underdeveloped and well-priced and incentive alignment institutional offering there could be a huge hit for a smaller bank that is currently struggling against their larger competitors.

- Attestations: the first to provide a robust and well priced reserve attestation service will get many clients as the stablecoin issuer space grows and with every participant competing for transparency. Current offerings are overpriced for most market entrants.

Furthermore, I believe that protocol and dApp teams and exchanges that are interested in becoming the euro market winners can work closely with the current issuers to form positive-sum relationships

I remain extremely optimistic as we head into 2024. Perhaps 2024 is the year of the euro stable?

Closing notes

Thank you for joining me on this tour de stable! If you found this piece helpful or informational, I would highly appreciate it if you would share it within your network. You can also follow me on LinkedIn or Twitter to stay up to date with the euro stablecoin market.

If you’d like to continue the discussion about onchain euros, we have a Telegram group titled “BRING EUROS ON CHAIN”. You can join it here.

References & footnotes

All markets and numerical data have been compiled over Dec 28-31, 2023. Some data may be older, as reflected in the open and freely available Euro Stablecoin Research repository here. If you think some of the data presented herein is false or inaccurate, please make a pull request to the GitHub repository. All currency conversions have been completed using the relevant day’s rate.

- DefiLlama https://defillama.com/stablecoins?pegtype=PEGGEDEUR

- Monerium https://monerium.com/about/

- Stasis; quarterly verification dated January 05, 2023. https://stasis.net/transparency

- Rekt https://rekt.news/iron-alpha/

- Etherscan https://etherscan.io/tx/0xe0279dd6774971bb00241ba5677bd7cc04a9fa098d11027fd5cafb69a36cfa45

- This figure includes some double counting as certain assets, such as DAI, used other stablecoins as their backing.

- Coindesk https://www.coindesk.com/business/2023/01/10/euro-stablecoin-eurr-issuance-ceased/

- https://www.coingecko.com/en/coins/e-money-eur

- https://monei.com/blog/bank-of-spain-digital-euro-eurm/

- https://www.euroe.com/blog/membrane-finance-launches-euroe-on-ethereum

- https://www.sgforge.com/societe-generale-forge-launches-coinvertible-the-first-institutional-stablecoin-deployed-on-a-public-blockchain/

- https://etherscan.io/address/0xf7790914dc335b20aa19d7c9c9171e14e278a134#writeContract

- The latter of these limitations was later removed, implementing a cancellation feature instead, see https://etherscan.io/address/0x6ab2c74fe8fb21a1136bd6e0432d38319232d0f7#code

- https://cryptoslate.com/crypto-developers-expose-absolutely-horrible-flaws-in-societe-generale-euro-stablecoin/

- https://medium.com/@zokyo.io/smart-contract-vulnerabilities-in-societe-generale-group-forges-coinvertible-stablecoin-24a18fec8e5b

- https://github.com/AngleProtocol/angle-docs/blob/main/whitepapers/Transmuter.pdf

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32023R1114

- https://assets.ctfassets.net/0x04pt0ewi4n/7eqIJVUOJeEq1UUByIyDzL/5221d493135dead91854c61a88556837/Bluechip_Assessment_-_Euro_Tether__EURT_.pdf

- https://www.euroe.com/blog/solana

- https://twitter.com/AngleProtocol/status/1706324175227416966

- https://www.theblock.co/post/266254/binance-compensation-aeur-stablecoin

- https://www.coindesk.com/business/2023/12/06/societe-generale-backed-euro-stablecoin-eurcv-starts-trading-on-bitstamp/

- https://www.binance.com/en/blog/ecosystem/what-challenges-are-there-for-stablecoin-rules-under-mica-7591396370591705502

- https://www.coindesk.com/policy/2023/09/21/binance-warns-of-multiple-stablecoin-delisting-as-lawyers-puzzle-over-eus-mica/

- https://www.anchoredcoins.com/en/landing/legal

- https://tether.to/en/legal

- https://www.circle.com/en/eurc

- https://tether.to/en/transparency/#reports

- https://monerium.com/financial-information/

- https://www.ssga.com/lu/en_gb/institutional/cash/funds/state-street-eur-liquidity-lvnav-fund-institutional-shares-ie0003411307

- EURCV whitepaper, available at https://www.sgforge.com/product/coinvertible/

- https://www.straitstimes.com/business/singaporean-backed-anchored-coins-launches-stablecoins-pegged-to-euro-and-swiss-franc

- https://www.binance.com/en/price/anchored-coins-aeur

- https://twitter.com/pablo_veyrat/status/1687861734281990144

- See https://hbr.org/2021/01/the-rules-of-co-opetition

- “Transparency and reserve verification”, Stasis, accessed 1 Jan 2024, available at https://stasis.net/transparency

- Corrected. Original post claimed as “Undisclosed”. Mykobo has one of the most robust and transparent reporting of all euro stablecoins, available at https://attestations.mykobo.co/